Combining Mayor Steven Fulop’s Pompidou x Jersey City proposal with Ward F Councilperson Frank Gilmore’s progressive income tax initiative would be great for Jersey City.

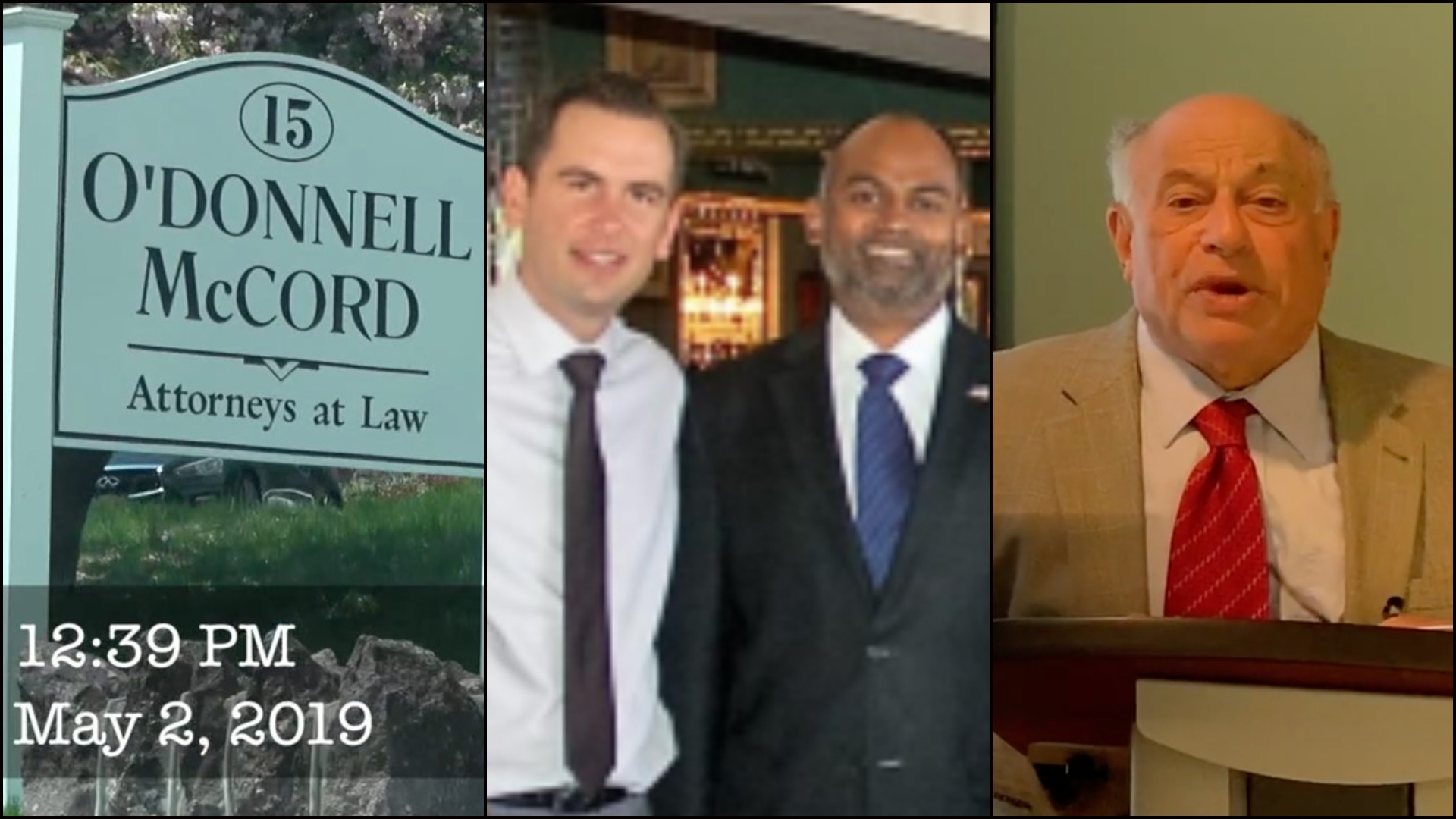

Mayor Steven Fulop, rendering of proposed Centre Pompidou x Jersey City, and Ward F Councilperson Frank Gilmore.

I don’t know anything about the industry, but someone recently told me the Centre Pompidou is the Kansas City Chiefs of the international art world – generational, revolutionary, etc. – and now I’m sold on Jersey City Mayor Steven Fulop’s plan to bring the French museum to New Jersey.

The proposed Centre Pompidou x Jersey City has drawn plenty of criticism. Tris McCall’s sobering piece for the Jersey City Times is probably the best read in that regard. In a vacuum, it’s a risky investment for the city that could backfire politically for Fulop.

Nevertheless, I see the vision for this project. If Fulop’s crowning achievement is anything, it’s the rise of Journal Square. By the time he’s running for governor there will be thousands of new housing units, a revitalized Loew’s Jersey Theatre, and an international art museum in the heart of Jersey City.

Conversely, the rise of Journal Square is part of a tale of two cities. It’s a complex story about the benefits of gentrification not trickling down to middle-class homeowners. It’s an ugly narrative about investing in elitist institutions rather than the city’s neediest youth.

Fulop can counteract the tale of two cities by partnering with Ward F Councilperson Frank Gilmore to establish a progressive local income tax capped at 1% to fund the Jersey City Board of Education.

In that scenario, thousands of new market-rate housing units – of which a disproportionate amount are studio/one bedroom apartments with no kids – would likely be generating enough income tax revenue to stabilize the school tax levy that’s been crushing property owners.

I wrote likely because the Fulop administration has not been helpful assisting Gilmore’s office in undertaking a study to determine how much revenue would be generated, despite a Jersey City Council resolution supporting the initiative. Hopefully the mayor reconsiders the idea, especially in terms of reforming the state’s school funding formula.

In addition to a progressive income tax, Fulop and Gilmore should consider reforming the local payroll tax to fund the city’s operations – which would probably increase collection and further stabilize/reduce the property tax burden.

Hate it or love it, the growth of Downtown & Journal Square over the past ten years has been remarkable; however, it’s important that everyone benefits from the modern urbanization of Jersey City and tax equity is one part of the solution.